What We Do

We facilitate NRN participation in Nepal’s socio-economic development.

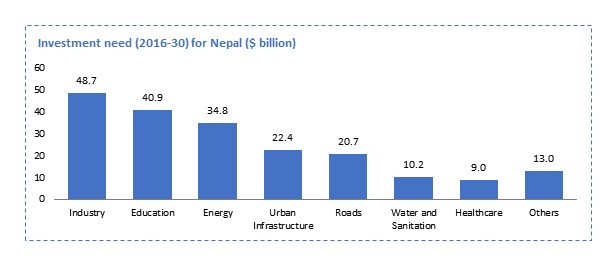

Government of Nepal envisages infrastructure investments worth USD 199 billion over the period of 2016–2030, of which transport, energy and industry collectively make up approximately 57% of the overall requirement. These investments translate to around USD 13 billion per annum.

Infrastructure investments in Nepal have been traditionally funded through budgetary allocations by the government, and multi-lateral and bi-lateral agencies. Although, Nepal needs annual investments of USD 13 billion, historically, the supply of funds has been just around USD 2.6 billion, 58% of which was from the government sources. Therefore, there is a significant funding gap that needs to be bridged.

Government of Nepal makes major investments for infrastructure development. Approximately 60% of the total requirement is fulfilled through capital expenditure of national accounts. Despite increasing allocation towards infrastructure, government funding is not sufficient to meet the country’s growing economic and infrastructure needs. Support from Development Financial Institutions (DFIs) has been significant in developing the sector. Funding from DFIs is for the long-term and spread across a repayment period of more than 30 years excluding moratorium periods. Despite 180 Banks and Financial Institutions (BFIs) in operation, the total infrastructure exposure of the BFIs is USD 6.31 billion, which is 18% of the total loans and advances.... Load More

Investment from capital markets is limited. The equity market comprises 219 listed entities at the securities exchange and is dominated by the financial sector. Bond markets are less developed with listings by government development bonds and corporate bonds raised by BFIs. Further, a majority of the trading is for equities (~97%), and the remaining is for mutual fund units and corporate bonds. The less-developed bond market could be attributed to (i) lower or negative returns compared to the government securities or fixed income instruments, (ii) absence of corporate ratings, and (iii) absence of price discovery instruments (yield curves) for bonds.

The current supply of funds from various sources does not meet the annual fund requirement for the development of infrastructure projects. Both markets and policies need to be revamped to facilitate the entry of new investors to support growth plans across sectors.

Nepal’s economy has grown slower compared to its South Asian neighbors. It has not followed the path of structural transformation that other fast-growing, emerging economies have experienced. While many countries have experienced rapid economic growth with modest reduction in poverty, Nepal is showing the opposite trend: slower growth with brisk reduction in poverty and income inequality. Still, Nepal remains one of the poorest and slowest growing economies. Its economic growth has hovered around an average of 4% in the last 20 years. In this sense, further progress and sustained economic growth in Nepal require targeted policies and investments. The World Bank (2014) emphasizes the importance of three I’s—investment, infrastructure, and inclusion—for the development of Nepal and recommends that, to take a major development leap toward middle income status, the country should achieve annual real Gross Domestic Product (GDP) growth rate of around 7%.

There have been various constraints on growth in Nepal: modest natural endowments, challenging topography, extractive political regimes, low level of physical and human capital, and a prolonged period of political transition. The current state of Nepali economy is also a result of poorly designed and implemented policies that have resulted in weak performance of the agriculture sector, low public investment, low capital accumulation, and low productivity growth. The country should focus on agriculture, tourism, transport, and energy sectors for development.

Infrastructure—energy, transport, water and sanitation, and urban development—is essential for the economic growth of a country. Infrastructure is a major input in the production of goods and services; it helps raise productivity, lower the cost of production and distribution, improve the standard of living, and reduce poverty. Overall, it functions as an engine of growth. In Nepal, however, the infrastructure is not only inadequate, but also fragile and poorly managed. Inadequate generation and supply of energy, weak transport connectivity, poor water supply and sanitation, and haphazard urbanization are impeding the growth of the country. To provide impetus to economic growth and development of the country, investment in infrastructure is essential. Show Less

How We Invest

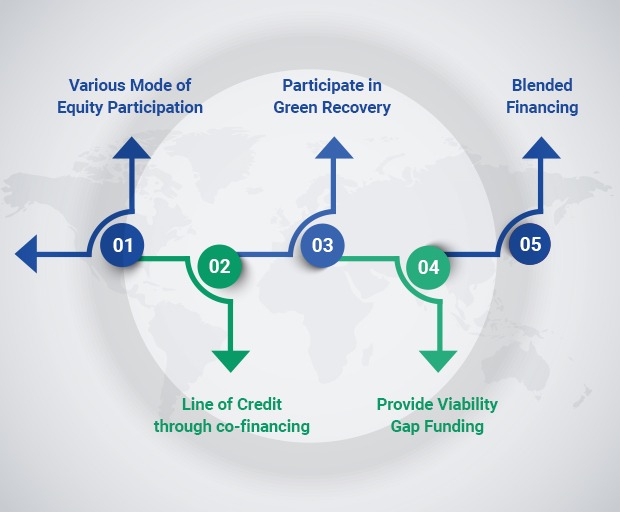

The following instrument will be offered for investment:

Investment Focus

Tourism

Agro and Forest Based

Manufacturing

Transport

Service Industries

Construction and Infrastructure

Information and Communication

Urban Development

Health and Education

Energy

Guiding Principles

Projects should be technically sound and financially viable.

Projects should support the basic growth objectives of Government of Nepal.

Projects should be environment-friendly and socially sustainable.

Projects should have private sector participation.

Risk Management

Nepal Development Fund (NDF) risk advisory services specialists understand complexity of the business environment and work to mitigate risks in a volatile and uncertain world. Risk management has been embedded within the culture at NDF, so the company is committed to managing and optimizing risk considering to achieve the return… Read more